Beesion Dunning & Collection Management System simplifies and extends the Bill-to-Cash process — bringing intelligence, automation, and unification to telecom revenue operations.

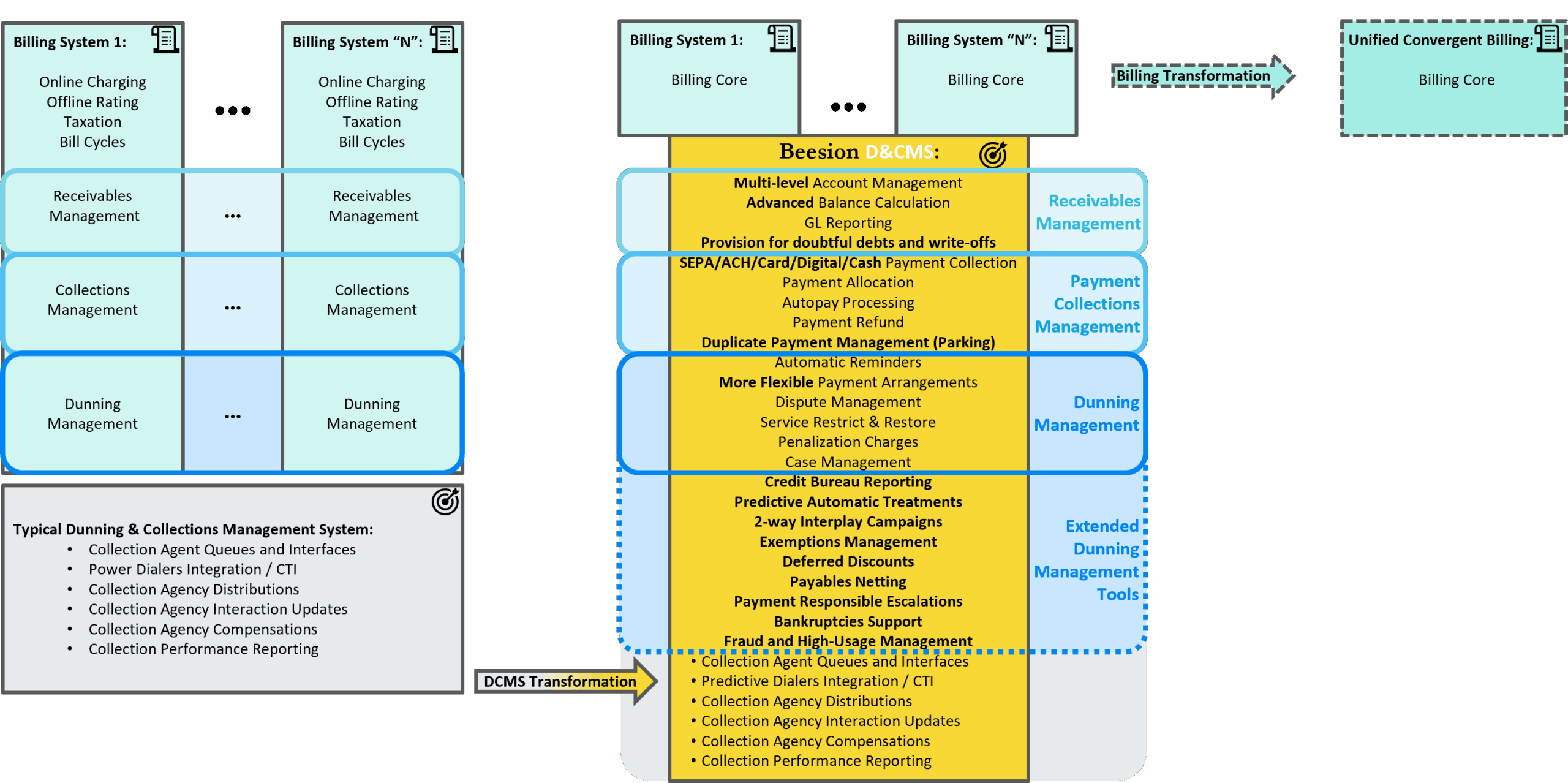

The Challenge: When Billing Systems Multiply, Efficiency Divides

Telecom operators often run multiple billing systems—across service networks, product lines, legacy platforms, or geographies. Each has its own charging, rating, taxation, billing cycle runs, receivables, and payment collection logic, creating silos that make it difficult to gain a single view of customer debt or cash flow.Symptoms finance leaders see

- Fragmented customer and debt data

- Inconsistent dunning rules and letters

- High operational & vendor costs

- Slow recovery; higher DSO and leakage

What convergence really requires

Unifying how collections is orchestrated—without a risky, big-bang billing migration. Finance needs a single control plane for receivables, treatments, and agency workflows.

“Multiple billing systems create multiple points of friction—not multiple advantages.”

The Transformation: From Disparate Systems to Unified Dunning

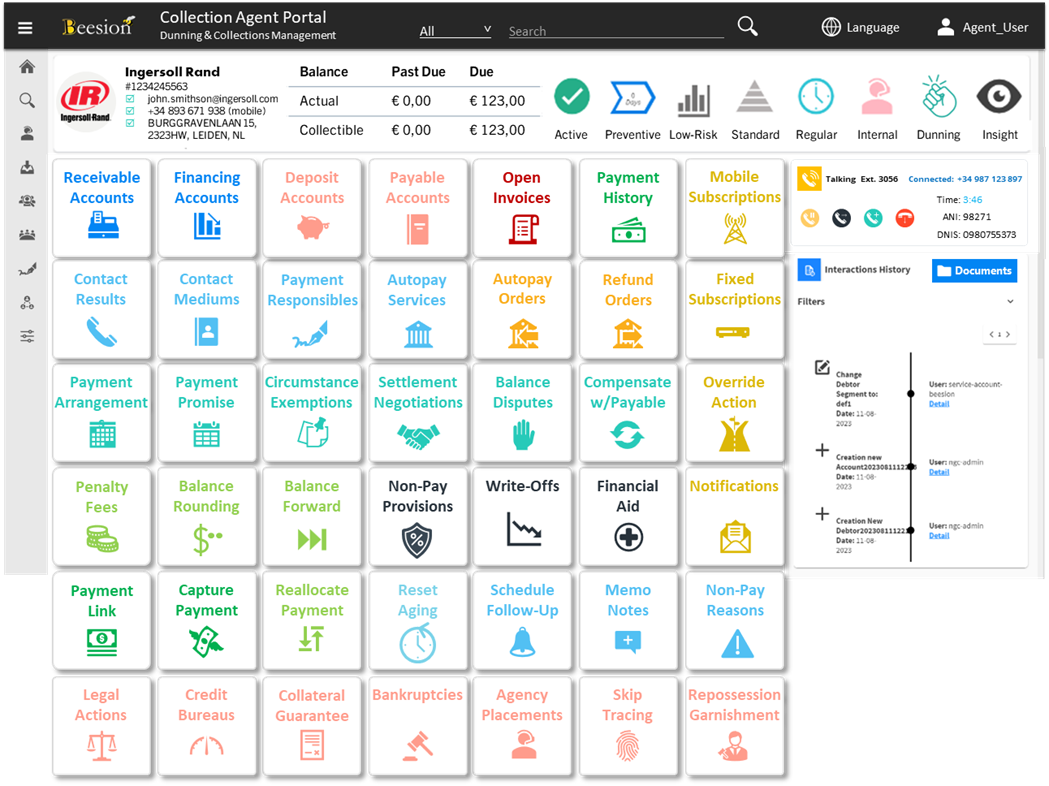

Beesion’s Dunning & Collections Management System (DCMS) acts as a centralized, intelligent layer between existing billing environments and enterprise finance, enabling a single, orchestrated Bill-to-Cash process across all lines of business.

Receivables Management

Advanced balance calculation, GL reporting, and automatic provisioning for doubtful debts & write-offs.

Collections Management

Autopay processing, payment allocation, conditional payment parking, refunds, and cash application control.

Dunning Management

Automated reminders, payment arrangements, dispute & penalty management, and robust case management.

From Siloed Billing-Embedded Functions to a Convergent D&CMS Layer

Traditional Architecture:

- Each service (e.g., Mobile, Cable, Internet) operates its own billing system.

- Dunning and collections functions are embedded within these systems, often in limited, inconsistent, and siloed forms.

- This leads to operational inefficiencies, duplicated logic, and disjointed customer experiences.

Beesion’s Transformation:

- Extracts and centralizes all dunning and collections-related functions into a dedicated, convergent D&CMS.

- Preserves core billing functions—such as rating, charging, and invoicing—within their native systems.

- Establishes a modular, interoperable layer that governs receivables, collections, and dunning across all services.

Advanced Capabilities that Change the Game

Predictive & Automated Treatments

Behavior-aware strategies prioritize the right action per customer — reducing manual work while improving recovery rates.

Two-Way Interplay Campaigns

Real-time, omnichannel conversations propose payment and settlement options — either scripted or powered by AI and Digital Channels.Metered Dunning Triggers

Usage-based escalation mechanisms dynamically respond to customer behavior, improving timing and effectiveness.Exemptions, Discounts & Netting

Flexible tools manage deferred discounts, payables netting, and exemptions with full auditability.Agency & Bureau Integrations

End-to-end support for agency queues, CTI dialers, distribution rules, and performance reporting — plus bureau escalations.Bankruptcy & Risk Handling

Built-in workflows for sensitive cases ensure compliance while preserving customer experience.Receivables Management

Account management, balance calculation, payment allocation, and GL provisioning for unified financial control.Symptoms finance leaders see

- Fragmented customer and debt data

- Inconsistent dunning rules and letters

- High operational & vendor costs

- Slow recovery; higher DSO and leakage

Collections & Dunning Management

Promise-to-pay tracking, case workflows, escalation tools, and tailored treatment orchestration.Integrated Reporting & Governance

Unified analytics for performance, compliance, and forecasting — providing central oversight and agility.- Costs Collections OPEX reduced via centralization

- Cash Faster recovery; improved DSO

- 1 View Unified receivables across systems

Process Re‑Engineering for the Modern Enterprise

This model goes beyond system integration — it represents process re‑engineering. Beesion proposes a shift from service‑specific legacy systems to a modular, unified platform that simplifies the Bill‑to‑Cash lifecycle. It’s a convergence strategy aligned with modern enterprise goals: agility, customer‑centricity, and cost‑effectiveness.- Scalability & Agility: Rapidly adapt to new services, policies, or regulatory frameworks.

- Governance & Insight: Centralized reporting enhances compliance, forecasting, and operational oversight.

- Customer Experience: Consistent, intelligent engagement across all touchpoints.

- Operational Efficiency: Reduced redundancy and faster revenue recovery.

From Complexity to Clarity

By unifying dunning and collections under one smart engine, operators move from reactive operations to proactive revenue orchestration.

-

Significant reduction in dunning & collections operating costs

-

Significant reduction in billing operating costs

-

Lower DSO and faster, more predictable cash

-

Central compliance and audit trails

-

Seamless path to Convergent Billing without replacing legacy systems

“Instead of forcing convergence through massive billing migrations, Beesion enables it through intelligent unification.”

Business Impact & Strategic Value

-

Operational Efficiency: Eliminates redundancy and manual reconciliation across systems.

-

Customer-Centricity: Enables unified, personalized treatment strategies across all services.

-

Scalability & Agility: Supports rapid adaptation to new services, policies, or regulatory requirements.

-

Governance & Insight: Centralized reporting and oversight improve compliance, forecasting, and performance optimization.

Why Finance Leaders Choose Beesion

Unified collections is not just a technical project—it’s a strategic lever for CFOs and finance directors to optimize liquidity and control revenue risk.

- Low-code configuration to adapt quickly

- Rapid deployment over existing billing systems

- Centralized insights across customer segments & regions

FAQs for CFOs & Collections Directors

Do we need to replace our billing systems to use DCMS?

No. DCMS overlays and integrates with existing billing platforms, unifying dunning and collections while you plan any future consolidation.