AI Applied to Collections Management

Conversational automation to improve payment rates and customer experience

Intelligent solution that integrates channels

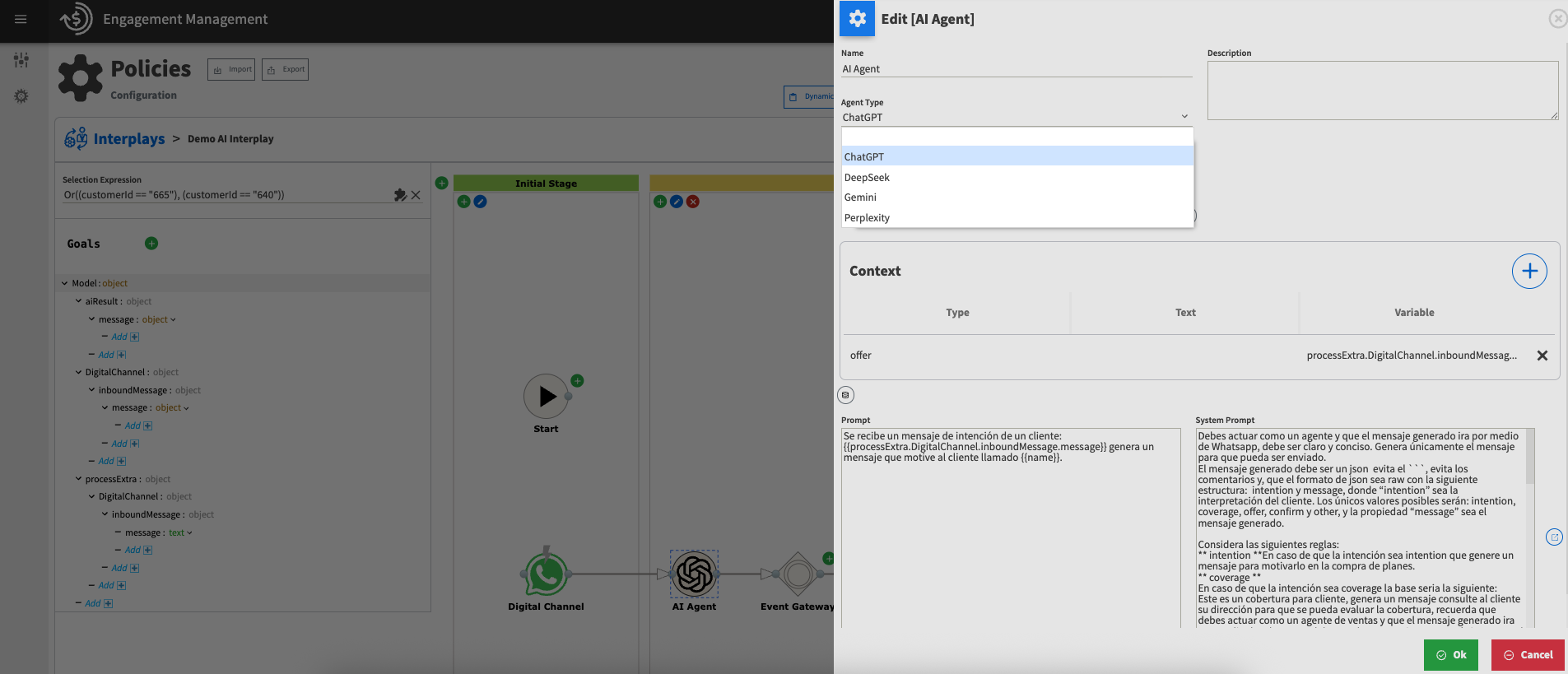

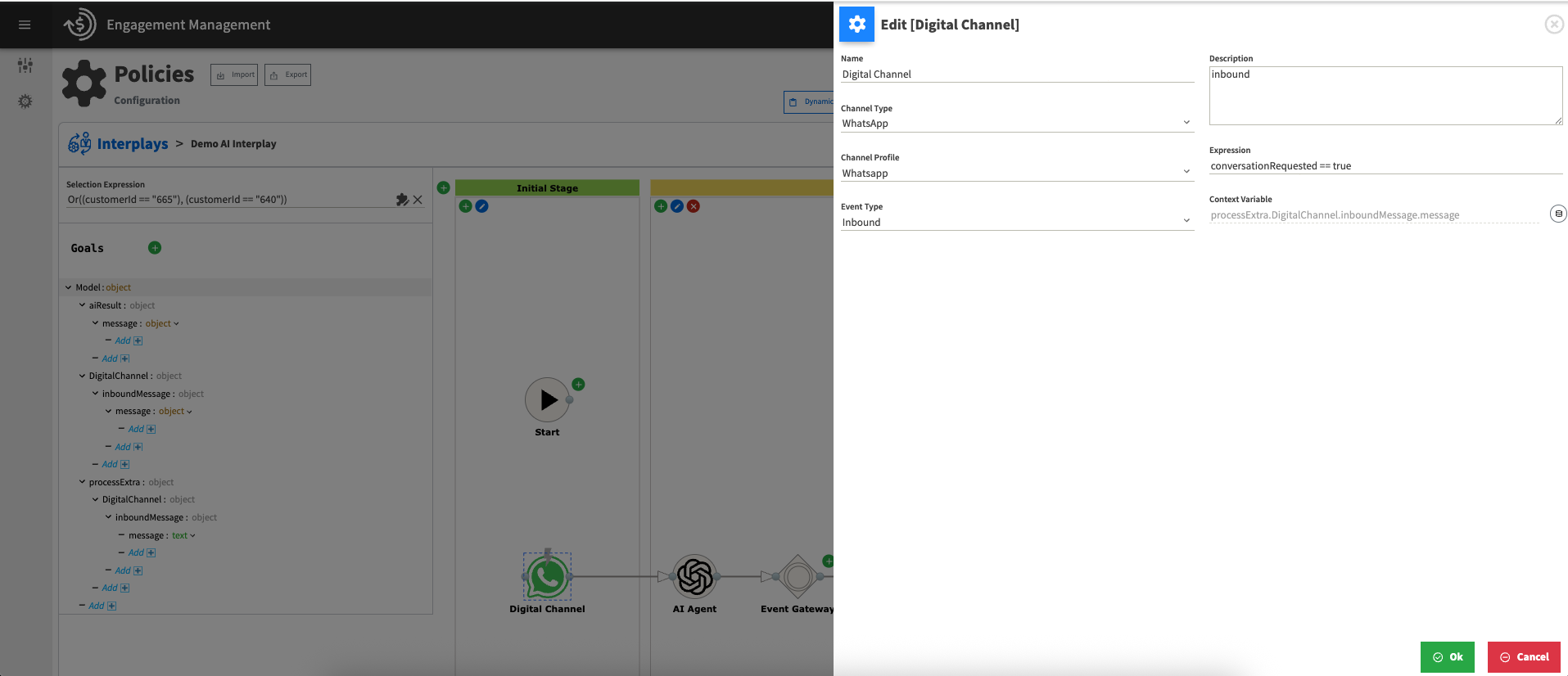

An intelligent and scalable solution designed to transform how organizations manage customer interactions in the collections process. It seamlessly integrates digital channels—such as WhatsApp—with cutting-edge AI agents like ChatGPT, Gemini, DeepSeek, and Perplexity.

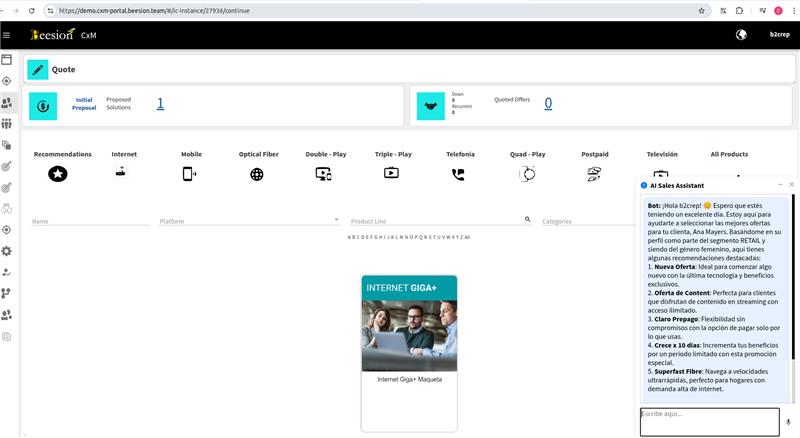

These agents are capable of interpreting the customer’s intent in real time, whether it’s a payment inquiry, a negotiation request, or general assistance. Once the intent is identified, the system automatically generates and delivers highly relevant responses that are clear, personalized, and persuasive—without the need for human intervention.

This approach not only accelerates response times and reduces operational costs, but also enhances the overall customer experience by providing consistent, 24/7 support through the customer’s preferred communication channels.

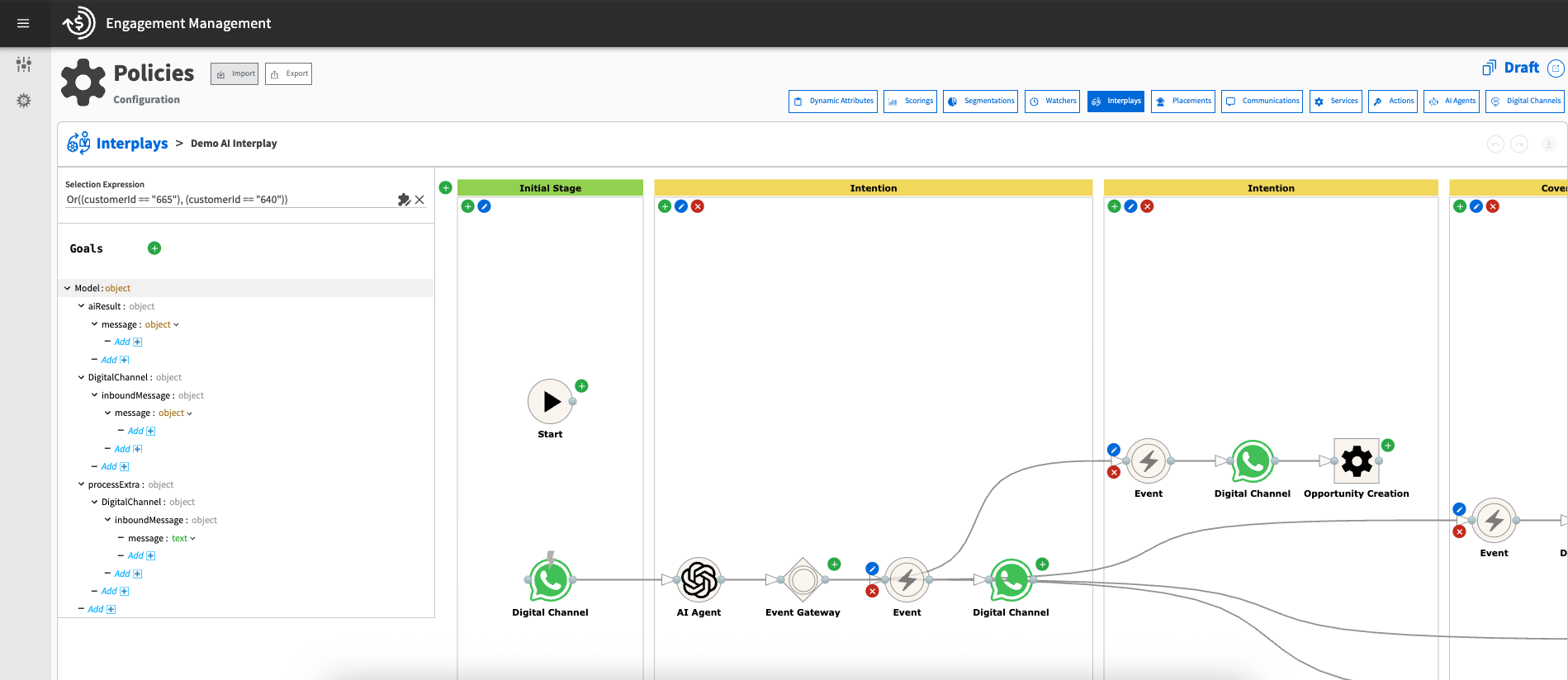

How does it work?

- Multichannel integration: Connect WhatsApp or other digital channels.

- AI-based intent detection: Understand the purpose: payment, inquiry, offer.

- Automated workflows: Send reminders, generate leads, offer promotions, or escalate to human agents.

Visual and intuitive interface

Designing automated workflows has never been easier. Our solution offers a no-code, drag & drop interface that allows business users to visually map out each step of the customer interaction flow—without needing technical expertise.

With clear visual stages and modular components, you can define actions, decision points, and outcomes in a matter of minutes. Contextual expressions and logic connectors make it simple to personalize journeys based on customer behavior, segmentation, or intent.

This flexibility empowers your team to quickly adapt strategies, A/B test different flows, and continuously improve performance—all from an intuitive and responsive design environment.

Available AI Agents

Our platform integrates with multiple AI engines, allowing you to choose the one that best aligns with your business strategy. Whether you prioritize conversational nuance, speed, or multilingual support, you can select from leading AI agents like ChatGPT, Gemini, DeepSeek, and Perplexity.

Each agent can be configured with custom prompts tailored to specific use cases—payment intent recognition, tone personalization, negotiation strategies, and more. This level of customization ensures that responses remain consistent, persuasive, and aligned with your collections objectives.

Track key performance indicators:

- Number of active partitions

- Execution status of workflows

- Version distribution across customer segments

Real-time monitoring

and metrics

Stay on top of every interaction and process with built-in real-time analytics. Monitor how your strategies perform and make adjustments on the fly without interrupting operations.

This actionable visibility helps you identify trends, measure success, and continuously optimize your AI-driven engagement flows.

This provides full visibility and helps you optimize your strategy.

Key benefits

Higher effective contact rate

Thanks to instant, AI-driven responses via familiar channels like WhatsApp, you can significantly increase the percentage of customers who engage with your communications.

Reduced agent handling time

Scalable without increasing staff

Consistent, traceable responses

Every message follows a structured logic, ensuring brand consistency and auditability. You can track what was said, why, and when, for full transparency.

Adaptable strategies for every stage of the collections journey

Our AI-powered platform is designed to handle multiple scenarios across the entire collections lifecycle—from early-stage engagement to advanced recovery strategies. Whether you’re looking to automate reminders, personalize offers, resolve inquiries, or recover aged debt, our solution adapts to your workflows and audience. By combining real-time intent detection with smart messaging, you can improve results across a wide range of use cases—without increasing operational effort.

Preventive and reactive collections

Description: Automatically engage customers before and after payment deadlines using behavior-based triggers.

Example:

- 5 days before due date: AI sends a friendly WhatsApp reminder.

- 2 days after due date: AI offers a payment arrangement via interactive message.

Benefits:

✔ Reduce delinquencies proactively

✔ Increase early payment rates

✔ Free up human agents from routine reminders

Personalized promotions

Description: Deliver custom offers based on the customer’s payment history, engagement score, or inferred intent (e.g. willingness to pay).

Example:

-

A customer who recently interacted with the bot receives a 20% discount if they pay within 48 hours.

-

AI detects “hesitation” in message tone and responds with a one-time incentive.

Benefits:

✔ Improve conversion of outstanding balances

✔ Increase engagement through relevance

✔ Aligns with dynamic scoring or segmentation

Automated inquiry handling

Description: Resolve frequent questions instantly, 24/7, using pre-trained AI responses and integration with billing systems.

Example:

- “What’s my current balance?” → AI fetches and responds within seconds

- “Can I change my payment method?” → AI provides options and a link to the portal

Benefits:

✔ Reduce inbound call volume

✔ Deliver consistent answers

✔ Improve customer satisfaction

Portfolio recovery automation

Description: Recover long-overdue accounts using multistep flows and adaptive language strategies.

Example:

- Week 1: Reminder with formal tone

- Week 2: Offer with flexible plan

- Week 3: Escalation with legal notification option or human agent involvement

Benefits:

✔ Extend recovery window without pressure on staff

✔ Customize approach based on risk profile

✔ Gain full traceability of all actions taken

Copyright 2024, Beesion, All right reserved. | Terms and Conditions | Privacy Policy