Calculate a Highly Predictive Credit Score

Use for telecom service prescreening, account monitoring and even debt collections efforts

Credit Analysis

Problem: Fixed-in-time credit score criteria

Every day, your sales teams run credit checks to determine whether potential subscribers can qualify for service. But there’s one big problem: the credit check is stuck in time.

But updating the credit scoring model, changing the business rules, updating and validating new criteria, and incorporating new information sources, requires a lot of coding and time.

Solution: Get Flexibility with Beesion

With Beesion’s telecom Credit Analysis software, it’s a breeze to update scoring models, fine-tune them, or change them completely. The low-code software is easy to update, expand and change – all without custom code. Plus, it integrates easily with new information sources, including actual payment behavior. This helps to calibrate the current scoring model and make it as predictive as possible.

The software complies with the Fair Credit Reporting Act and multiple legal/regulatory systems. And it can be adjusted easily when the regulations change, or your products do.

Determine Credit Risk Accurately Prior to Sale

Beesion’s Credit Analysis application determines if the purchase request is approved, rejected, requires more data for a decision, or different levels of authorization. It can build credit scoring models to predict customer payment behavior based on:

- Multiple scoring criteria that a credit expert or actuary determines as the best predictors of creditworthiness

- Predictive analytics and artificial intelligence techniques that use historical data points that find hidden correlations between customer variables and actual payment patterns

The software can also use a combination of both to build the credit scoring model.

Moreover, it has pre-built connectors to TransUnion and Experian, as well as small or international credit bureaus.

Easily Configure Business Rules and Criteria to Change Credit Scoring

The software includes a credit authorization process template that can be easily modified.

Any business analyst – with a little training –can make changes to:

- The workflows or business rules that are used to evaluate a credit request

- The evaluation data and values that make up a credit score

- The points in the sales process to check credit

Monitor Existing Subscribers’ Accounts and Report Changes

If subscribers declare bankruptcy or their credit situation has changed substantially, the software will automatically update the subscribers’ credit score (provided the software is integrated with credit bureaus).

Credit Agency Notification

Beesion’s Credit Analysis software will also update Credit Bureaus, if a customer churns for non-pay

Purchase Limit

The credit score also stores a maximum limit. Subscribers can make purchases until the limit is met, without any need to re-run credit.

The limit is recalculated automatically. If the subscriber’s credit improves, the limit is raised.

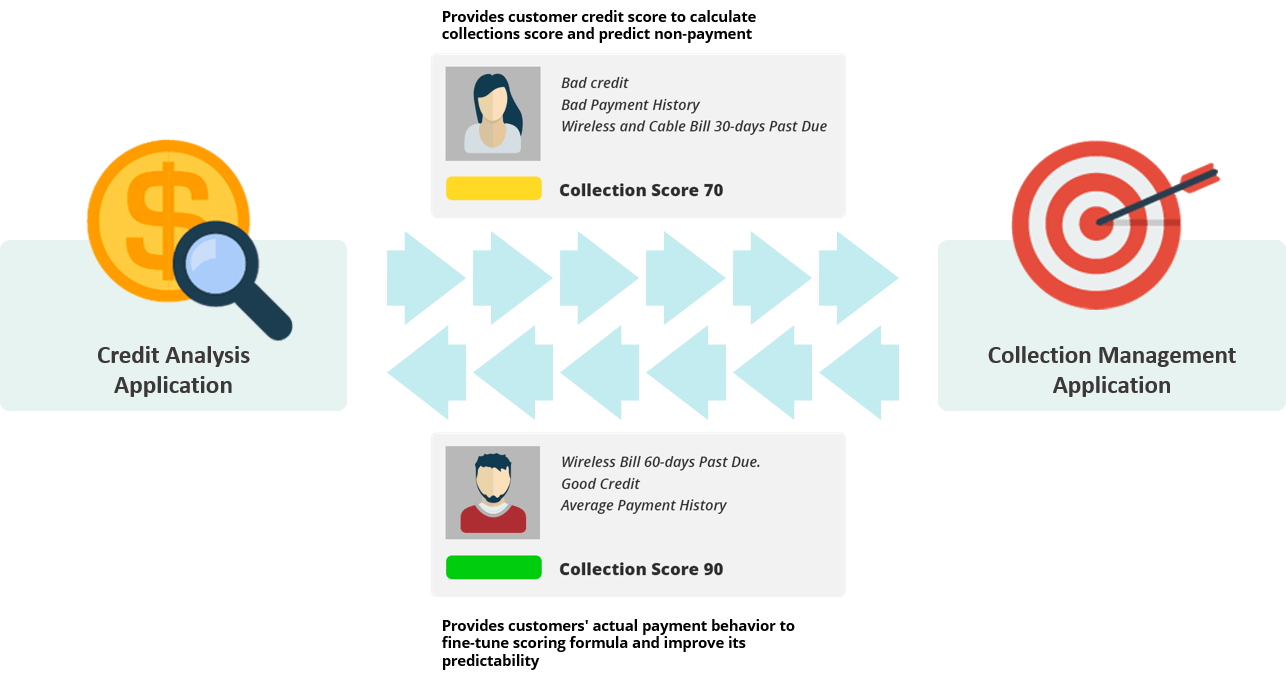

Use Credit Score as Part of Debt Collections Effort

In addition, the Collections Management application feeds payment information to the Credit Analysis application to create more accurate credit-scoring formulas.

Want to know more about Credit Analysis?

Copyright 2024, Beesion, All right reserved. | Terms and Conditions | Privacy Policy